Where selling option time premium meets momentum.

It’s Tuesday, 1/16/24. A lot of back-story in these first paragraphs, but if you want to jump to the trading details, skip down to Trading Plan.

I’m 2 years from retirement and about 2 years ago started seriously looking for a way to earn just 10% per year on what should be a nest egg of almost $1M. 100k/yr from that plus a pension about a third of that, plus Social Security some years later would be more than comfortable with the house paid off. But that would only replace about half our current incomes, so 15% return would be better (and allow us to travel more, help kids and grandkids, etc.).

I’ve had good luck in the past short-term trading ETFs based on momentum (something about that idea has always appealed to me), but it was hit or miss, so I was looking for something more consistent. That’s when I discovered The Wheel; mad props to Reddit user ScottishTrader for his work on, and posts about that in Reddit’s thetagang subreddit. I’m convinced that with discipline, The Wheel on ETFs would easily yield 20% per year. So I had settled on that.

And then a co-worker (shout-out to MB) just getting into options asked me about Credit Spreads, which I’d tried before but abandoned for some reason. Probably in favor of The Wheel. But when I looked at them again, and then started trading them again, I saw how powerful they are, and generally how consistent. And the defined loss aspect really appeals to me. I’ve been trading them again seriously for a month now and I’ve been impressed with the returns, and the potential.

Then 2 weeks ago I happened on one of the “0.75% per week” posts of Reddit user u/m756615, and saw that he’s been doing something similar to what I’m doing: Put and Call Credit Spreads on ETFs (plus some other option trades). For a couple years now I’ve been enamored of the idea that 1% per week is such a nice round number, and that it should be possible with options. The “0.95%” thing is to hopefully pre-empt those who’ll inevitably say “1% a week can’t be done.” Kinda like how things are priced at x.95, it rounds up to 1%. u/m756615 inspired that with his “0.75% per week” thread title, and then went on to make 49% by Week 34. (I suspect that he too was after 1% per week but didn’t want to say it.)

“…strategies which buy stocks that have performed well in the past … generate significant positive returns over 3- to 12-month holding periods.” — Jegadeesh and Titman (1993, Journal of Finance)

“Momentum persists” is what that says. That and other studies have proven it. What could be simpler than looking at a stock’s price chart, seeing that it’s going up, and thinking, “I wish I was on that ride!” Or looking at a chart that’s going down and thinking, “I’m glad I’m not in that stock.” That’s how I’ve always treated stock trading. I don’t try to predict, only react to current price performance.

A note about stocks: they’re volatile. Elon Musk can make an ill-advised tweet (X-eet?) and TSLA drops 10%. ETFs are baskets of stocks and not susceptible to “single-ticker risks.” A 10% drop will wreck most any bullish option trade you’d have on Tesla. The ETF ARKQ has TSLA as its #1 holding: but it’s only 12% of the ETF. So a 10% drop in TSA is about a 1.2% drop in ARKQ. A blip. All my bullish trades will be on ETFs.

But bearish trades? I want that single-issue risk, I want a CEO to say something profoundly stupid. It’s said that the market takes the escalator up, but the elevator down. Individual stocks even more so: they’re much more likely to drop than spike up. So for bearish trades I’m usually looking at stocks.

Trading Plan

Tldr: Credit spreads (Bull & Bear) on non-leveraged ETFs based only on price momentum.

ETFs, mostly non-leveraged.

No gold (it’s burned me too many times), and none of the main indexes (S&P, Dow, Nasdaq).

Put Credit Spreads & Call Credit Spreads – maybe 50/50, maybe skewed toward market direction. I’m afraid of market drops, and purely Bullish plays would all suffer, so my thinking is that half Bull/half Bear would ease the pain; more on that below.

30-delta or so for the short leg. (Typically the strike closest to 30 delta, even if higher.)

2 strikes wide, to allow room to roll if necessary (1-wide doesn’t work, I’ve found that out). That may need to increase.

Nominally 30DTE: If weeklies, expiration closest to 30 days (so it could be 27DTE) If monthlies, 28 to 45 days.

Immediately set a Buy To Close order at 75% profit. Or take them off with half the DTE left and redeploy the capital, because the trade didn’t work as expected. (You’ll note a lot of the Tasty Trade methodology here.)

5% position sizing based on spread width, not Max Loss.

10 trades at a time. That’s 50% invested, but that 50% isn’t at risk of total loss. Losses due to overall market downturns should be mitigated with CCSs on weak ETFs (more likely weak stocks). Position size and/or number of positions will likely come down as I gain more data. I know these numbers are high.

Diversify “broadly.” (Don’t have 2 semiconductor or 2 China trades on at the same time, for example.)

Don’t try to predict direction, only react. Trend follow.

I have Barchart watchlists of:

• Non-leveraged ETFs.

• Leveraged ETFs. (These will be for CCSs only, if needed.)

• The top 200 stocks by market cap. (For CCSs only; may need to go here if I can’t find viable ETFs trending down.)

Using the Performance Chart View, 1-month timeframe, start evaluating from the top/best down.

• If strikes are crazy-wide, or Open Interest too low, skip it. (Subjective for now.)

• If it passes that test, look at the chart.

- No TA, this is strictly subjective. (No Moving Averages, RSIs, MACDs, Bollinger Bands, or oscillators.)

- Minimum 1-month up-trend, preferably 2 or 3.

- No major drops in that time. (Subjective for now. I haven’t tried to quantify it, but know it when I see it.)

• For bearish Call Credit Spreads, start at the bottom of Performance Chart View and work up.

I’ll take off and put on trades as necessary to stay at 10 (generally long and 5 short). The coming-off should be automatic with the pre-staged BTC orders. I work from home a lot so I’m able to watch the account, and new trades should go on intra-day. But I also travel sometimes and can’t do that, so those will be staged the night before.

Risk management: I haven’t set strict rules around this. Most of the risk management is built into the trade setup and position

sizing, but some options after trades are in play:

• Don’t do anything, wait/pray and maybe take Max Loss?

• But since I should be taking off at half the DTE, they shouldn’t get to that point.

• If the short Put or Call gets to some delta (40? 50?) then:

o Roll out?

o Sell the spread on the other side to build an Iron Condor or Butterfly?

o Buy back at twice the premium? 3x?

Specific trade data will be noted for 1-lots, regardless of how many contracts I actually open. But week-ending account balance and percent gain will be given. Probably through the week, but definitely on the weekends I’ll list the details of all the trades opened or closed, with past-week trade screenshots from ThinkorSwim.

Percent gains for each trade will be calculated as net premium (taking out trading fees) divided by collateral (spread times 100).

Supplementary thoughts on targeting 1% per week

To get 1% per week for the account overall, I’ll need to see at least 2% from each trade, since the account is half-invested. As I see it, there are a few ways to go about this:

• Let the trades ride till profit or time target.

• Take off when 2% per week is hit.

o Do you then say that that 5% of cash is done for the week?

o Or do you put it in another trade and risk losing it?

• Only commit the dollar amount necessary to make 1% for the account. But then do you:

o Assume the trade goes to expiration, so you keep the full credit?

o Or assume you take it off at 50% profit? I like this one better.

• Sell at way lower delta and actually target 2%/wk? (But then I think you’re into the “steamroller effect,” risking dollars to make pennies.)

For example, ARKG after hours on Tuesday 1/16 is pricing as follows for 16Feb, 31 days out:

• 26/28P at 29Δ for 0.45. Take off 1.32 for trading fees and that’s: 43.68/200 = 21.8%. Divide by 4.6 weeks to get 4.7%/wk. That’s 3x my target. (About the same if it came off at 50% profit in 2 weeks, say.)

• So maybe go to a lower strike? The 24/26P at 14Δ is going for 0.20. After fees that’s 2.0%/wk. But I’d probably have to hold it longer to get all of that.

• So stay with 30Δ, but sell when 2%/wk is hit?

o Assuming that’s likely to happen in the first week, I’d need 2% of the $200 collateral, so only $4.

o Trading fees for the round trip are 2.64, so call that 3, and add it to the profit target of 4 to get $7.

o $45 for the trade – $7 gross profit would have me taking the trade off at 0.38, or only 18% into it, not 50%.

o That would work, and would minimize exposure time. Reload that 5% next week.

The Account

This is my wife’s Roth IRA, with privileges to do spreads of course. I chose hers for this experiment because I’m more cautious with her money than mine. At the open today, Tuesday (Monday was a holiday), 1/16/2024, the balance was $13,159. (In future I’ll refer to that as NetLiq, Net Liquidating value.)

I’m calling this Week 0 because the account isn’t doing strictly spreads yet. There are two stocks I’ve been selling covered calls on that are tying up $2334, but those should get called away Friday, and then it’ll be strictly Credit Spreads, Put and Call.

Coming into this week there were already several active spreads in it. But since they’re in progress I won’t spell them out here. But I did open 2 new Call Credit Spreads today, so I’ll list them below under “Tuesday.”

And that’s how I’ll document each week: probably each night I’ll post what trades came off and went on. Or if not daily, then I’ll catch up on the weekends.

If you want to chat with me, I’m ‘Theinkdon’ on Reddit, and also at Google mail. The comments section here is flooded with spam, so don’t bother with that.

Tuesday 1/16/24

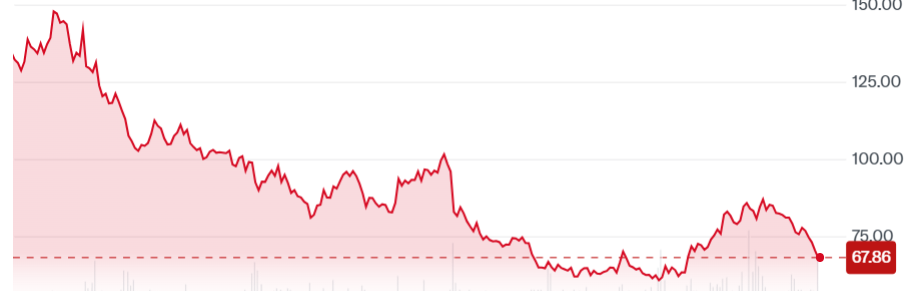

This is the 1-year trend for ETSY. Would you say it’s generally going up, or down? I see down, so I played it as a Call Credit Spread.

The 5-day is terrible, and if that trend holds I’ll be out of this bearish trade in just a few days. Let’s see how it goes.

Sold the 9Feb (24DTE) 73/75C spread for 0.44. The 75C was at exactly 30Δ. (I went “in” to 24 days because the16Feb expiration (the normal “monthly” expiration) had $5 strikes and I couldn’t get close to 30Δ. My choices were 34 (too high) and17 (way too low), so I scooched in a week.)

I put a Good Till Cancelled BTC order on it at 0.11 which is 75%.

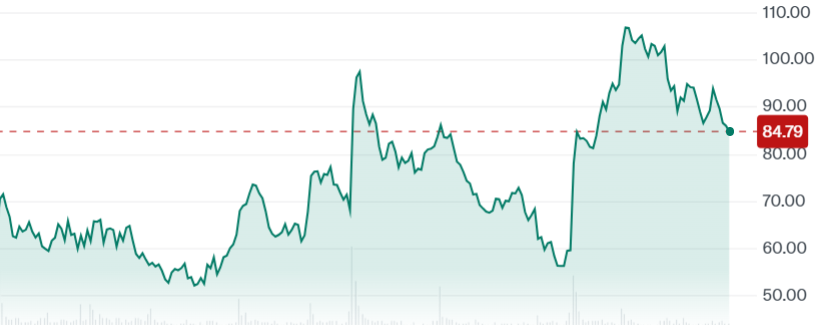

ROKU 1-year. Going up or down? Harder to call, but I’m betting it retraces down to 70 like it did after that previous peak.

The 3-month mostly confirmed that, which I cut off with the left edge at Nov28, so ROKU has been in a downtrend for 1.5 months. I look for at least 1m.

And how about this 5-day?

That’s all I do for Technical Analysis, just look at the trends and figure they’ll keep going that way for a time.

So I sold the 9Feb (31DTE) 105/100C (27Δ) for 0.85. BTC at 0.41.

Wednesday 1/17

FXI 16Feb24.5/22.5C (30Δ) for 0.31.

This one was interesting because it wouldn’t fill at the price the platform quoted as the Mid, 0.30. So I lowered to 0.29, but it didn’t fill. Then 0.28, no fill. Even though the B/A spread at the 30Δ short leg was 1c (no spread at all), and at the 8Δ long leg 3c. So I decided to leg into it, maybe the first time I’ve done that. With the long leg pricing 0.05/0.08, I offered to buy it at 0.06 and got filled. Then with the short leg at 0.36/0.37, I asked 0.37 and got filled. So I got in the CCS for 0.37 – 0.06 = 0.31. Mind you, it wouldn’t fill at 0.30, 0.29, or 0.28 earlier. And right after the second leg filled I set up the vertical spread order as if to buy it again, and it priced at 0.29. Go figure. So I made an extra $2 per contract, which equates to 1% on this 2-wide spread. Doesn’t sound like a lot, but remember that this is a 30DTE trade, so that’s 12% per year additional return.

Thursday 1/18

MSOS 3-month. Looks like a “normal” dip and it’s ready to leg back up. Recent support at 7.

16Feb is 29DTE. 7P at 28Δ, 6P at 15Δ, so 13 deltas between. Got 0.32 for it.

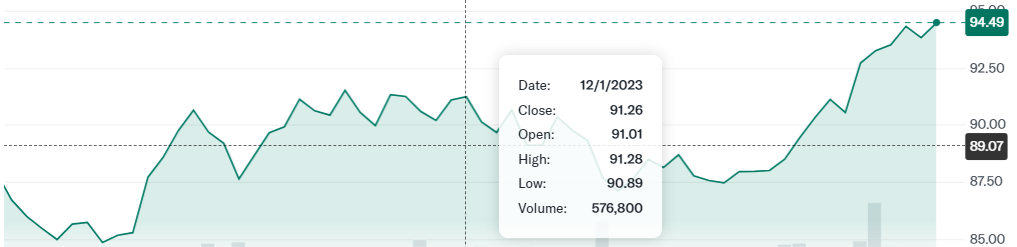

DXJ 3-month. 16Feb/29DTE.

92P at 29Δ. To get 10Δ between, needed to go 2-wide. 90P at 17Δ, so 12 deltas between . Got 0.37.

ITB 3-month. It weathered the recent market downturn well, and the dip 2 weeks back was only down to 97.70. 97.5P at 31Δ, 95.5P at 22Δ to get close to 10 delta between. Got 0.50.

Monday 1/22

Balance at 11:40 was 12,680.

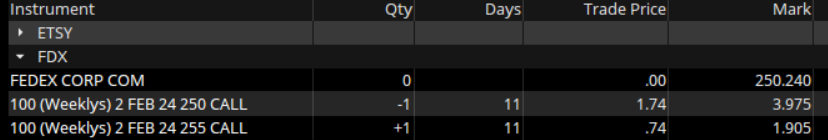

FDX from 1/18 barely breached the short Call, so I sold a PCS against it to make it an IC.

240/245P at 26Δ for 0.81.

Gross credit now 1.81, or 36% of spread width.

promo codes for 1xbet https://www.cooks.am/pag/1xbet_promokod_pri_registracii_na_segodnya_besplatno.html

Казино Вулкан https://vulkan.electronauto.ru

solutions

“Bravo!”

“Keep it up!”

“You’re amazing!”

Top 5 Crypto Casinos in 2024 https://medium.com/@passeu/top-5-crypto-casinos-in-2024-83c74854313e

Lucky block licensed crypto casino 2024 https://medium.com/@passeu/lucky-block-licensed-crypto-casino-2024-c3a8673f0fab

licensed crypto casino 2024 https://medium.com/@passeu/zkasino-no-deposit-bonus-2024-afb0be126002

licensed crypto casino 2024 https://medium.com/@passeu/lucky-block-licensed-crypto-casino-2024-c3a8673f0fab

licensed crypto casino 2024 https://medium.com/@passeu/lucky-block-licensed-crypto-casino-2024-c3a8673f0fab

licensed crypto casino 2024 https://medium.com/@passeu/cloudbet-sign-up-bonus-online-gaming-with-cryptocurrency-e69ece256319

This has opened up a new perspective for me.

You’ve made a complex topic accessible.

Слоты и онлайн-игры в казино способны разнообразить жизнь человека. Важно только правильно выбрать площадку — она должна быстро и честно выплачивать выигрыши, надежно хранить персональные данные клиентов, предлагать большой ассортимент развлечений и интересную бонусную программу. Важную роль играют также наличие адаптированной мобильной версии и приложений. https://enic-kazakhstan.kz/

Escort Gazette review guide with free verified ads in Europe. Best Escort Girls, Strip clubs, Brothels, Massage parlors on the map. Easy search directory. https://prxdirectory.com/listings12691077/escort-gazette-review-guide-with-free-verified-ads-in-europe

The Basic Principles Of buy injectable steroids. https://bookmarksbay.com/story17006502/the-definitive-guide-to-buy-injectable-steroids

Wow, fantastic blog layout! How lengthy have you been blogging for?

you made running a blog glance easy. The overall

glance of your web site is fantastic, as well as the content!

You can see similar here e-commerce

Real informative and superb body structure of subject matter, now that’s user friendly (:.

“Bravo!”

“Impressive!”

“Fantastic!”

“Well done!”

“Fantastic!”

“Well done!”

“Excellent!”

“Bravo!”

“Keep it up!”

“Excellent!”

“Well done!”

“Keep it up!”

“Great job!”

“Bravo!”

“Fantastic!”

Spot on with this write-up, I really think this website needs far more consideration. I’ll in all probability be once more to learn rather more, thanks for that info.

“You’re amazing!”

“Nice work!”