Thesis: find boring ETFs that don’t move much, sell Iron Condors on them.

What underlying doesn’t move much? Treasury bonds.

What ETFs cover government bonds? These have daily average volumes of >2,000,000 shares:

BIL, GOVT, IEF, IEI, SGOV, SHV, SHY, SPTI, SPTL, TFLO, TLT, USFR, VGIT, VGLT, VGSH

TMF/TMV (3x), TYD/TYO (3x)

I’ve argued before that for spreads you don’t need leverage, so exclude those.

Some don’t have options, and some that do are thinly-traded, so exclude those, then sort by average volume:

TLT, IEF, VGLT

TLT & IEF have weeklies, so I’ll concentrate on those.

And let’s see if we can stay at or outside Expected Move, so about 20Δ.

It’s Friday, 1/26/24, about 3PM.

IV numbers for 2Feb24, which is 7DTE, are 9% for IEF, and 16% for TLT.

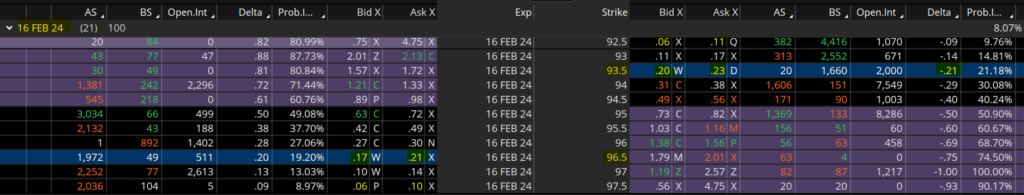

So let’s try IEF first. I had to go out 3 weeks to get nice 20Δ legs. Spot was 94.94, and I inadvertently cut off EM, but it was plus/minus 1.45:

1-wide gives me 10 deltas between the legs of each spread, and there’s good Ask and Bid sizes, and mostly good Open Interest, but the protective Call leg has only 5 contracts open. Let’s see if it’ll fill:

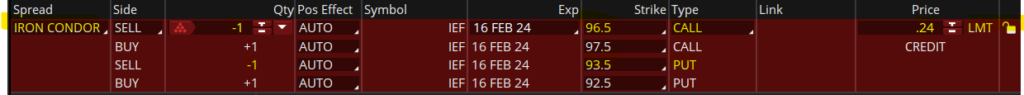

It didn’t. I let it sit for a full minute, then lowered to 0.23. Another minute, then 0.22. Another minute, then 0.21, where it filled.

Okay, so grossing $21 means subtracting 0.66 four times for this 4-legged spread. That leaves 18.36. And because the wings are 1-wide, that’s 18%. Over 3 weeks is 6% per week. Which is huge, especially since the underlying is bonds, and way out at EM.

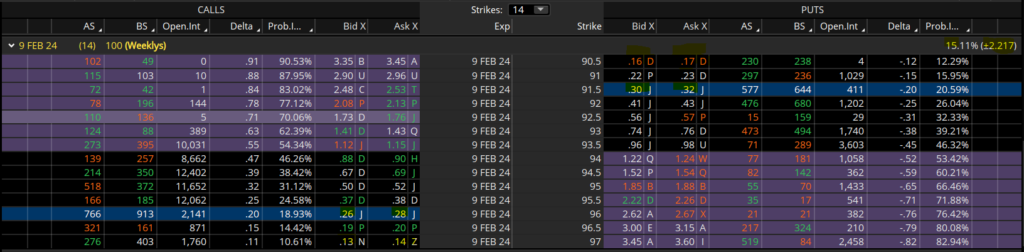

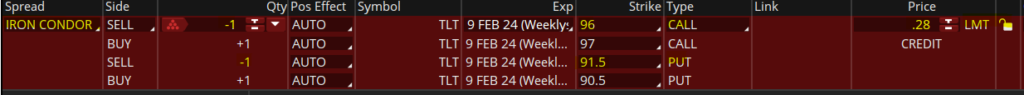

But I didn’t like having to give up 3 cents from Mid (which was 12.5% of the premium), so let’s try TLT. Spot is 93.75, and 14DTE gave me two good 20Δ legs:

Notice already the much tighter B/A spreads, and much better Open Interest. TLT trades 49 million shares per day, vs. IEF at 11.7 million. Let’s see if that translates to a better fill:

It did: I put the order in just how ToS offered it to me, and it filled within 2 seconds.

$28 nets to 25.36, which gives 12.6% per week on this 2-week IC.

IEF would’ve yielded 7.1% per week if it had filled at Mid. Part of the difference from that to TLT‘s 12.6% is because IEF was over 3 weeks vs. TLT’s 2 weeks. But part of it must be due to TLT’s IV of 15% vs IEF’s of just 8%. I can’t explain why that is, except that TLT covers 20+ year bonds, while IEF covers 7-10 year bonds; and maybe the longer-term bonds are more volatile?

So I’ll stick with TLT, which has the added advantage of trading Wednesdays and Fridays in the 2 front weeks.

12% a week is a LOT, so using that same TLT option chain, what if I backed down to 15Δ, or 12, or 9? (The next rows you can’t see.) I kept those 1-wide still, though that doesn’t give me 10 deltas between, so they could be directly compared to the first trade. Here’s all 4 trades, which I placed today with real money:

| 20Δ | 0.27 | 12.1%/wk |

| 15/16Δ | 0.20 | 8.6% |

| 12Δ | 0.14 | 5.6% |

| 9Δ | 0.10 | 3.6% |

So What Could Go Wrong?

What could move TLT enough in a week or a month to challenge one side of an iron condor?

- It has dividends, but they’ve only been running about 30 cents at the beginning of each month. The distance between short strikes in even the most-restrictive 20Δ IC is 4.50, and 0.30 is only 6.6% of that, so that by itself shouldn’t cause much problem. (Only if spot was already pretty close to the short Put leg.)

- And 30c is only about 4 deltas, even ATM. (Less if further OTM.) So that shouldn’t change things much. And because “taking the dividend out of the price” would move spot closer to the Put wing, the corresponding pulling away from the Call wing should counterbalance it, so the value of the whole spread might remain mostly unchanged.

On Reddit 2 years ago someone asked about doing ICs on TLT specifically, and got this answer:

“TLT makes some wild swings when the markets go wild. I suggest you read up on Treasuries before doing ICs on TLT.”

So I looked back at 5 years of TLT for “wild swings.” There was a 6-month downtrend that ended in October 2023, and then a deeper fall that ended in October 2022 that saw TLT lose 23%, but that was over 3 months so it should be survivable if using shorter timeframes.

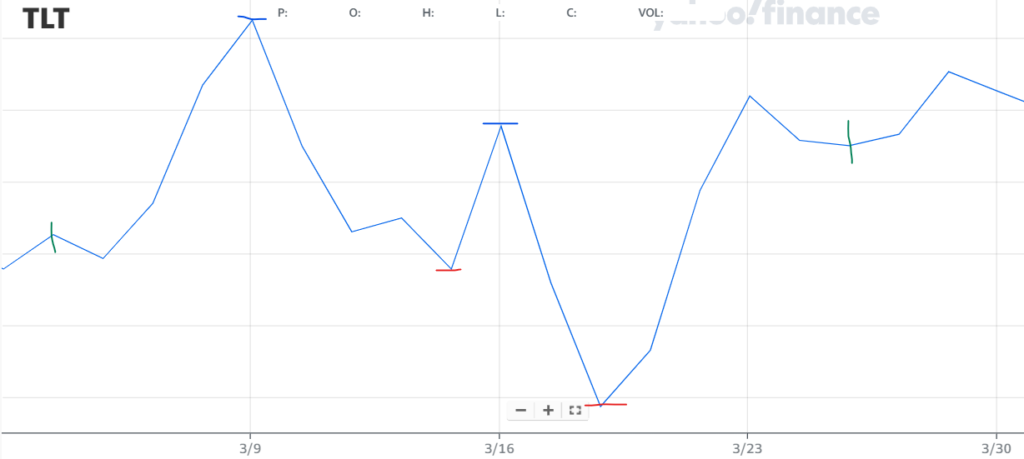

Then I thought of COVID: if anything was to give “wild swings,” it would probably be that. Here’s March of 2020:

The peak on 3/9 was 171.29. The 1st valley on 3/13 was 153.94. That’s a drop of 10%. Pretty huge for a Treasury Bond ETF. And to put that in perspective: there’s barely 10% between the short legs of the most-conservative 9Δ trade above. But it was also over the course of 5 trading days, so maybe it could’ve been managed.

On 3/16, Monday, TLT opened at 160.38; that’s up 4.2%.

But then that drop to 144.35 was another 10% drop.

But even that recovered over the next 3 days.

Note the two vertical green lines I drew bracketing the whipsaws:

The left one is at 156, with the right one at 163. A difference of about 4% and 3 weeks between them. I picked those two points because they’re about where TLT was before and after the “wild swings”:

So that’s almost a 2-month view of what TLT did through COVID. About as wild as “wild swings” are likely to get, and probably quite survivable if you just held on to your TLT ICs, or took other countermeasures.

Semi-random thoughts

“Iron Condors decay most nearest to expiration.”

“You can be more successful with a 70/30 win/loss ratio than a 90/10.”

Inverse ETFs decay naturally, so selling Calls on them is a little bit faster/safer.

Hey Guys,

Warning: From February 2024, all existing email autoresponders will become obsolete!

In fact, if you want to send marketing emails, promotional emails, or any other sort of emails starting in February 2024, you’ll need to comply with Gmail’s and Yahoo’s draconic new directives.

They require regular marketers like you and I to setup complex code on sending domains… and existing autoresponders like Aweber and GetResponse are not helping: they’re requesting you do all the work, and their training is filled with complex instructions and flowcharts…

How would you like to send unlimited emails at the push of a button all with done-for-you DMARC, DKIM, SPF, custom IPs and dedicated SMTP sending servers?

What I mean by all of that tech talk above, is that with ProfitMarc, we give you pre-set, pre-configured, DONE-FOR-YOU email sending addresses you can just load up and mail straight away.

We don’t even have any “setup tutorials” like other autoresponders either, because guess what: we already did all the setup for you!

All of our built-in sending addresses and servers are already pre-warmed with Gmail and Yahoo and they’re loving us: 99% inbox rate is the average!

⇒ Grab your copy here! ⇒ https://ext-opp.com/ProfitMarc

Hey Guys,

Warning: From February 2024, all existing email autoresponders will become obsolete!

In fact, if you want to send marketing emails, promotional emails, or any other sort of emails starting in February 2024, you’ll need to comply with Gmail’s and Yahoo’s draconic new directives.

They require regular marketers like you and I to setup complex code on sending domains… and existing autoresponders like Aweber and GetResponse are not helping: they’re requesting you do all the work, and their training is filled with complex instructions and flowcharts…

How would you like to send unlimited emails at the push of a button all with done-for-you DMARC, DKIM, SPF, custom IPs and dedicated SMTP sending servers?

What I mean by all of that tech talk above, is that with ProfitMarc, we give you pre-set, pre-configured, DONE-FOR-YOU email sending addresses you can just load up and mail straight away.

We don’t even have any “setup tutorials” like other autoresponders either, because guess what: we already did all the setup for you!

All of our built-in sending addresses and servers are already pre-warmed with Gmail and Yahoo and they’re loving us: 99% inbox rate is the average!

⇒ Grab your copy here! ⇒ https://ext-opp.com/ProfitMarc

Hey Guys,

Warning: From February 2024, all existing email autoresponders will become obsolete!

In fact, if you want to send marketing emails, promotional emails, or any other sort of emails starting in February 2024, you’ll need to comply with Gmail’s and Yahoo’s draconic new directives.

They require regular marketers like you and I to setup complex code on sending domains… and existing autoresponders like Aweber and GetResponse are not helping: they’re requesting you do all the work, and their training is filled with complex instructions and flowcharts…

How would you like to send unlimited emails at the push of a button all with done-for-you DMARC, DKIM, SPF, custom IPs and dedicated SMTP sending servers?

What I mean by all of that tech talk above, is that with ProfitMarc, we give you pre-set, pre-configured, DONE-FOR-YOU email sending addresses you can just load up and mail straight away.

We don’t even have any “setup tutorials” like other autoresponders either, because guess what: we already did all the setup for you!

All of our built-in sending addresses and servers are already pre-warmed with Gmail and Yahoo and they’re loving us: 99% inbox rate is the average!

⇒ Grab your copy here! ⇒ https://ext-opp.com/ProfitMarc

He Got 256,354 Free Views With AI…

Can you believe it?

People spend thousands of dollars to get that kind of result…

My friend Kundan just did it for free…

He only used his new app… AI ScreenSnap…

It’s the world’s first AI app that can generate videos with the power of Video-Exclusive AI Engine…

That can edit, record, and generate videos with just a few clicks… with zero experience…

Click here now and watch AI ScreenSnap in action https://ext-opp.com/AIScreenSnap

He Got 256,354 Free Views With AI…

Can you believe it?

People spend thousands of dollars to get that kind of result…

My friend Kundan just did it for free…

He only used his new app… AI ScreenSnap…

It’s the world’s first AI app that can generate videos with the power of Video-Exclusive AI Engine…

That can edit, record, and generate videos with just a few clicks… with zero experience…

Click here now and watch AI ScreenSnap in action https://ext-opp.com/AIScreenSnap

Surveillance

securitysolutions

“Keep it up!”

“Great job!”

“Excellent!”

“Well done!”

“Impressive!”

“Bravo!”

“Bravo!”

Top 5 Crypto Casinos in 2024 https://medium.com/@passeu/top-5-crypto-casinos-in-2024-83c74854313e

Lucky block licensed crypto casino 2024 https://medium.com/@passeu/lucky-block-licensed-crypto-casino-2024-c3a8673f0fab

licensed crypto casino 2024 https://medium.com/@passeu/cloudbet-sign-up-bonus-online-gaming-with-cryptocurrency-e69ece256319

Слоты и онлайн-игры в казино способны разнообразить жизнь человека. Важно только правильно выбрать площадку — она должна быстро и честно выплачивать выигрыши, надежно хранить персональные данные клиентов, предлагать большой ассортимент развлечений и интересную бонусную программу. Важную роль играют также наличие адаптированной мобильной версии и приложений. https://enic-kazakhstan.kz/

Escort Gazette review guide with free verified ads in Europe. Best Escort Girls, Strip clubs, Brothels, Massage parlors on the map. Easy search directory. https://lukasaoaj69146.getblogs.net/58598973/best-escort-girls-strip-clubs-brothels-massage-parlors-on-the-map-easy-search-directory

Escort Gazette review guide with free verified ads in Europe. Best Escort Girls, Strip clubs, Brothels, Massage parlors on the map. Easy search directory. https://seymourl813wjv1.thebindingwiki.com/user

The Basic Principles Of buy injectable steroids. https://becketterer92479.dm-blog.com/26515421/buy-injectable-steroids-secrets

Wow, awesome blog layout! How lengthy have you been blogging for?

you made running a blog glance easy. The whole look of your site is excellent, let alone the content

material! You can see similar here sklep

Great write-up, I am regular visitor of one’s blog, maintain up the nice operate, and It is going to be a regular visitor for a long time.

“Well done!”

“Keep it up!”

“Great job!”

Very nice post. I just stumbled upon your weblog and wanted to say that I have truly enjoyed browsing your blog posts. In any case I will be subscribing to your feed and I hope you write again very soon!

“Great job!”

“Excellent!”

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

“Impressive!”

“Bravo!”

“Keep it up!”

“Bravo!”

“Great job!”