covered calls TRADE LOG

I started doing this Tuesday, March 1st, 2022. The idea was to sell the time premium in the Call option closest to a stock’s price, and to do that in a “covered” way, which just means that you own the stock, so if the option you sold gets “exercised” you simply hand over those shares. But you get to keep the premium you sold the Call for. Plus any appreciation in the stock from where you purchased it up to the strike price.

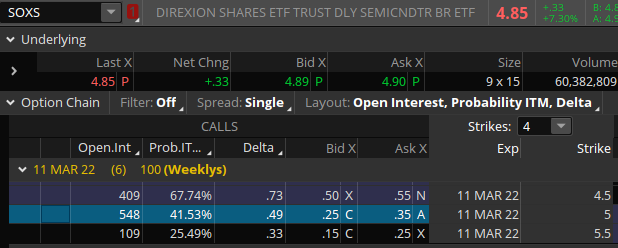

Here’s the idea, using one of the symbols I traded last week:

It’s the weekend and the markets are closed, so those prices are a bit “stale,” but they’re close enough for this discussion. SOXS closed Friday at 4.85. The $5 strike Call option for NEXT Friday, 7 Days to Expiration (7DTE) had a Bid of 0.25 and an Ask of 0.35. The Midpoint of those is 0.30, and that’s what you could expect to get filled at Monday if SOXS opens at 4.85, or maybe a penny or two lower. But I’ll use the Bid of 0.25, because that means there’s definitely a buyer for that 11MAR 5C option at 25 cents. But because option contracts are for 100-lots of stocks, they’ll be paying $25.

And this is where it gets fun, and where the profit comes from: it’s the time-value of that option that we’re selling, the flexibility it gives the contract-holder to be able to buy that stock for $5 any time in the next 5 trading days. I don’t own any SOXS, so I buy 100 shares at 4.85, for a total investment of $485. Now I sell that Call to someone for $25, which gives them the option to buy my shares for $5 by March 11th. The trade can now go 3 different ways, but let’s first analyze the case where SOXS finishes next week at exactly $4.85.

My shares haven’t lost or gained anything, but the option-holder won’t want to buy them for 5.00 when he could just buy them on the open market for 4.85, so that contract is worthless, and I keep the whole $25 premium. (And note that you ALWAYS keep all the premium you sold a Call for. So what just happened? We got paid $25 by someone who might’ve wanted to buy our shares 5 days later, but that didn’t pan out for him. We had $485 invested and made $25 on it in a week. Big whoop, right? But that’s a (25/485) = 5.1% return, in ONE WEEK. And we can do that again next week, and the next week, and … multiply by 52 weeks and that’s a simple annual return of 265% if you could do it week after week.

But CAN you do that week after week? That’s what I’m here to document. But let’s look at an even BETTER outcome: SOXS closes next week above $5, say it’s 5.10. Our Call holder will “exercise” his option and take our shares, which is okay because that’s what we signed up for. BUT, besides the $25 premium we got, we ALSO have the stock’s appreciation from 4.85 up to the strike price of $5. We don’t get any of the appreciation past that, but that’s okay because: we bought the stock at 4.85 and sold it for 5.00, a gain of $15 on 100 shares, and we get to add that to the $25 premium for a total gain of $40. And (40/485) is an 8.2% gain in 1 week. Simple-annualize that to 425%.

But of course sometimes stocks go down, so what does THAT look like? Well, the $25 premium we collected lowers our cost basis. 4.85 – 0.25 = 4.60, which means the stock could go down to 4.60 before we’d start losing money. Which is about a 5% drop in stock price before our trade is negative. And if that does happen, you can close the trade at or near that breakeven point of 4.60 and look for a better trade. OR you can hold onto the shares and sell more premium further out in time and possibly turn the losing trade into a winning one, and/or give the stock time to rebound if you want. I’ll discuss those as they happen, and I had one last week.

Click these buttons for more trades: